Sprout

Team: Sprout

Program:

Center for Leadership Education, Computer Science

Project Description:

The Venture Capital industry promises some of the greatest returns to investors, allowing them to make potentially astronomical returns on their initial investment. However, access to venture capital is restricted to ultra-wealthy individuals, massive investment banks, and other large financial institutions. Currently, in order to invest in venture capital, you must be considered an accredited investor, meaning you make over $200,000 per year or have a net worth over $1 million.

This lack of access has caused the industry to grow into an exclusive, homogeneous group that has awarded funds to an equally non-diverse group of founders. 96% of VC money is managed by people who identify as White. Of the startups funded by top VC firms, 90% of the companies were founded by men. These disparities exist geographically as well. 80% of all VC investments have taken place in major metropolitan centers specifically on the West Coast and Mid-Atlantic. And to really drive home just how exclusive of a club venture capital is, 40% of all VC general partners went to either Harvard or Stanford. Clearly, venture capital is currently a space where value is determined by who you know rather than what you’re building, and the quality of investments has suffered as a result of these highly-skewed demographics. We at Sprout know there has to be a better way.

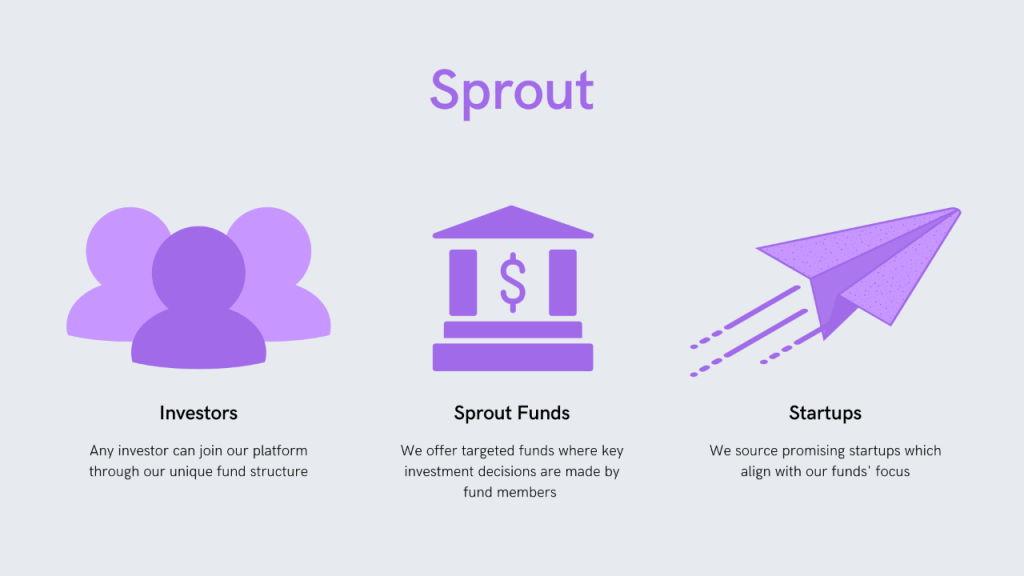

Sprout is an investment platform which enables anyone to participate in venture capital using our unique fund structure. We regularly announce funds with specialized topics like “FinTech” or “Female Founded Ventures”. Once these funds reach their target goal, we put forth companies for the fund’s contributors to diligence. Our app walks them through a due diligence process which allows users to rate the financials, founding team, business model, and more of the company. Furthermore, Sprout provides forums for users to discuss their takes on the validity of the startups. At the end of the due diligence window, we ask our users to vote on the company: do they want to invest or will they pass. Their votes matter! If the community believes in the company’s potential and has voted to back it, the fund invests and the investors become full stakeholders. Once a company within a fund is acquired or completes an initial public offering, we allow users to exit their position with returns proportional to their initial investment.

Sprout aims to make Venture Capital equity and decision making accessible to everyone. Over the next 10 years we hope to build a user base that will be representative of the greater US population who are using Sprout to engage in direct venture investing while minimizing their risks. Sprout is opening up the last frontier of finance to everyone, to be the Venture Capital of the people.

Team Members

-

[foreach 357]

-

[if 397 not_equal=””][/if 397][395]

[/foreach 357]

Project Mentors, Sponsors, and Partners

Course Faculty

-

[foreach 429]

-

[if 433 not_equal=””][/if 433][431]

[/foreach 429]

Project Links

Additional Project Information